salt tax deduction repeal

A new bill sponsored by a pair of Democrats in the House of Representatives seeks to repeal the 10000 cap on state and local tax deductions. House Votes to Temporarily Repeal Trump.

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The middle class would get an average tax cut of about 37.

. While the 10000 ceiling on the SALT deduction is set. 5-Year SALT Cap Repeal Would Be Costliest Part of Build Back Better Nov 2 2021 Taxes According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one retroactive year. Many New Jersey residents pay more than 10000 in property taxes.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000 and that most middle. A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and local taxes SALT and offset the cost over ten years by. We should be able to deduct our full property tax.

Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be retroactive to 2021. Since the SALT cap was put into place however very high earners have seen a sharp reduction in the deduction as a percent of AGI from 77 percent in 2016 for those earning over 500000 to 071 percent in 2018. The so-called SALT tax cap imposed a 10000.

Policymakers are considering other options to reform or repeal the SALT deduction cap. According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue through 2025 when the SALT cap is scheduled for repeal.

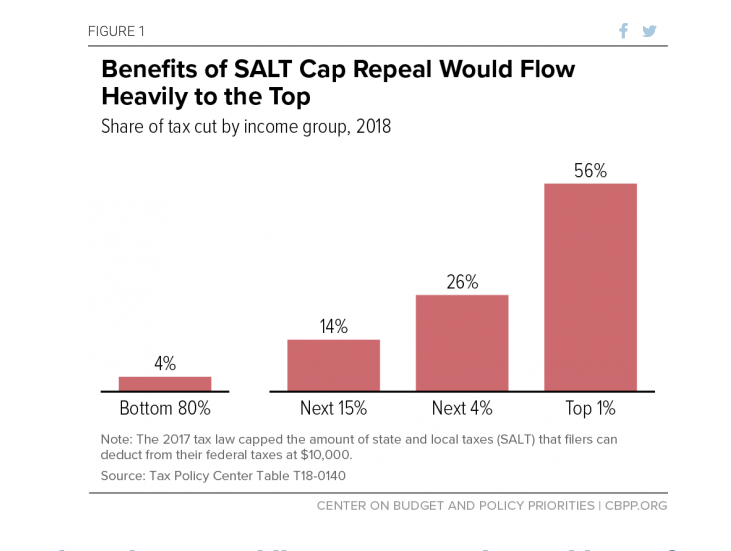

The SALT tax deduction is currently capped at 10000. The left-leaning Brookings Institute found that the top 20 percent of earners would receive 96 percent of benefits of lifting the cap on SALT deductions. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes.

The much-maligned top 1. TPC estimated repeal would reduce federal tax revenues by 620 billion between. House Democrats agreed to a compromise that would raise it to 80000 per year but it was part of the broader Build Back Better Act which.

The chief similarities between the SALT deduction limit and the CTC expansion are that both have run up against President Bidens 400000 pledge and encountered non-trivial intraparty head. A defining characteristic of the Tax Cuts and Jobs Act TCJA passed into law in late 2017 is the significant limitation imposed on the deductibility of state and local income property and sales. Blue-state Democrats have been fighting since 2017 to repeal a key provision of President Trumps tax plan that penalized high-cost California filers.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. The lawmakers have asked the US. 54 rows The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income.

Legislative efforts to repeal the SALT cap are stalled. The top 1 percent of households those making 755000 or more would receive more than 56 percent of the tax cut. Democrats leave SALT cap repeal out of initial version of tax plans Zachary Halaschak September 13 2021 1044 AM D emocrats released the first look at proposed tax changes for their.

However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. President Bidens all but dead Build Back Better bill proposed to change the SALT cap deduction to 80000 a move that would reduce the federal income tax liability by 559 billion in 2021 but. To be specific the top 1 percent would get an average tax cut of over 35000.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Why Repealing The State And Local Tax Deduction Is So Hard

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

This Bill Could Give You A 60 000 Tax Deduction

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Bullish Streaks The Stock Market Was Down Slightly On Thursday But The Amazing Year For Stocks Continues The Chart Below Shows Stock Market Chart Income Tax

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix